Exhibit 99.1

Forward-Looking Statements

2

This presentation contains forward-looking statements. All statements other than statements of historical

facts contained in this presentation, including statements regarding Micronet Enertec’s future results of

operations and financial position, financial targets, business strategy, plans and objectives for future

operations, are forward-looking statements. The Company has based these forward-looking statements

largely on its current estimates of its financial results and its current expectations and projections about

future events and financial trends that it believes may affect its financial condition, results of operations,

business strategy, short-term and long-term business operations and objectives, and financial needs as of

the date of this presentation. These forward-looking statements are subject to a number of risks,

uncertainties and assumptions. Moreover, the Company operates in a very competitive and rapidly

changing environment. New risks emerge from time to time. It is not possible for Company management

to predict all risks, nor can the Company assess the impact of all factors on its business or the extent to

which any factor, or combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements the Company may make. In light of these risks, uncertainties

and assumptions, the forward-looking events and circumstances discussed in this presentation may not

occur and actual results could differ materially and adversely from those anticipated or implied in the

forward-looking statements.

facts contained in this presentation, including statements regarding Micronet Enertec’s future results of

operations and financial position, financial targets, business strategy, plans and objectives for future

operations, are forward-looking statements. The Company has based these forward-looking statements

largely on its current estimates of its financial results and its current expectations and projections about

future events and financial trends that it believes may affect its financial condition, results of operations,

business strategy, short-term and long-term business operations and objectives, and financial needs as of

the date of this presentation. These forward-looking statements are subject to a number of risks,

uncertainties and assumptions. Moreover, the Company operates in a very competitive and rapidly

changing environment. New risks emerge from time to time. It is not possible for Company management

to predict all risks, nor can the Company assess the impact of all factors on its business or the extent to

which any factor, or combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements the Company may make. In light of these risks, uncertainties

and assumptions, the forward-looking events and circumstances discussed in this presentation may not

occur and actual results could differ materially and adversely from those anticipated or implied in the

forward-looking statements.

More detailed information about the risk factors affecting the Company’s performance is available under

the heading “Risk Factors” in the Company’s Annual Report on form 10-K filed with the Securities and

Exchange Commission (the “SEC”) on March 29, 2013, which is available on the SEC’s website,

www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements,

which reflect management’s analyses only as of the date hereof. The Company neither intends to, nor

assumes any obligation to, update or revise these forward-looking statements in light of developments

that differ from those anticipated.

the heading “Risk Factors” in the Company’s Annual Report on form 10-K filed with the Securities and

Exchange Commission (the “SEC”) on March 29, 2013, which is available on the SEC’s website,

www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements,

which reflect management’s analyses only as of the date hereof. The Company neither intends to, nor

assumes any obligation to, update or revise these forward-looking statements in light of developments

that differ from those anticipated.

Statement on Pro Forma Financials

The pro forma condensed consolidated financial information included in this investor presentation

is constructed from the separate financial statements of the Company and Micronet Ltd.

(“Micronet”), in which the Company has a controlling interest, and may not represent the financial

information that would result from operations of the combined companies. In addition, the pro

forma condensed consolidated financial information included in this investor presentation is based

in part on certain assumptions that we believe are reasonable. We cannot assure you that our

assumptions will prove to be accurate over time. Accordingly, the historical and pro forma

condensed consolidated financial information included in this investor presentation may not reflect

what the Company’s results of operations and financial condition would have been had we been a

combined entity during the periods presented, or what our results of operations and financial

condition will be in the future. The challenge of integrating previously independent businesses

makes evaluating our business and our future financial prospects difficult. Our potential for future

business success and operating profitability must be considered in light of the risks, uncertainties,

expenses and difficulties typically encountered by recently combined companies.

is constructed from the separate financial statements of the Company and Micronet Ltd.

(“Micronet”), in which the Company has a controlling interest, and may not represent the financial

information that would result from operations of the combined companies. In addition, the pro

forma condensed consolidated financial information included in this investor presentation is based

in part on certain assumptions that we believe are reasonable. We cannot assure you that our

assumptions will prove to be accurate over time. Accordingly, the historical and pro forma

condensed consolidated financial information included in this investor presentation may not reflect

what the Company’s results of operations and financial condition would have been had we been a

combined entity during the periods presented, or what our results of operations and financial

condition will be in the future. The challenge of integrating previously independent businesses

makes evaluating our business and our future financial prospects difficult. Our potential for future

business success and operating profitability must be considered in light of the risks, uncertainties,

expenses and difficulties typically encountered by recently combined companies.

3

Micronet Enertec Technologies Inc.

NASDAQ: MICT

NASDAQ: MICT

4

• Delaware corporation, USA based

• Develop, manufacture & market:

§ Advanced mobile ruggedized computers, tablets and equipment that are

embedded & integrated in commercial applications

• Focus on two billion-dollar vertical markets

1. Aerospace/Defense

2. Mobile Resource Management (MRM) / Fleet Management (FM)

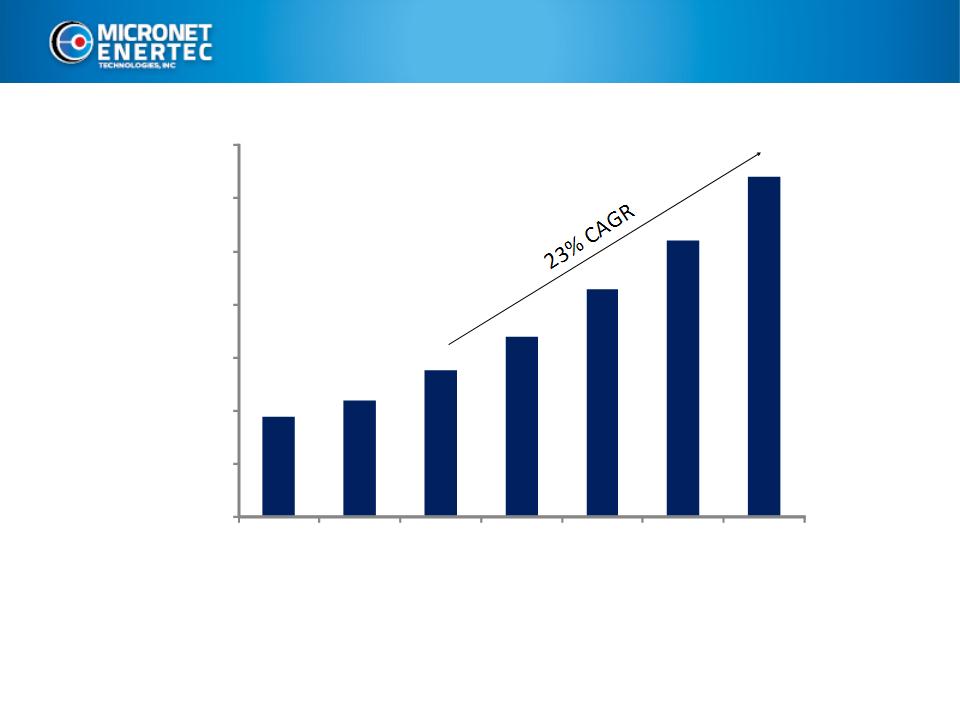

§ 23% CAGR for global MRM market and expect continued growth

• Corporate structure

§ Own 100% Enertec Systems - Aerospace/Defense

§ Own 54% Micronet Ltd - MRM & FM

• R&D and operating subsidiaries: Israel

• Joint venture: India

• Sales presence: United Kingdom

5

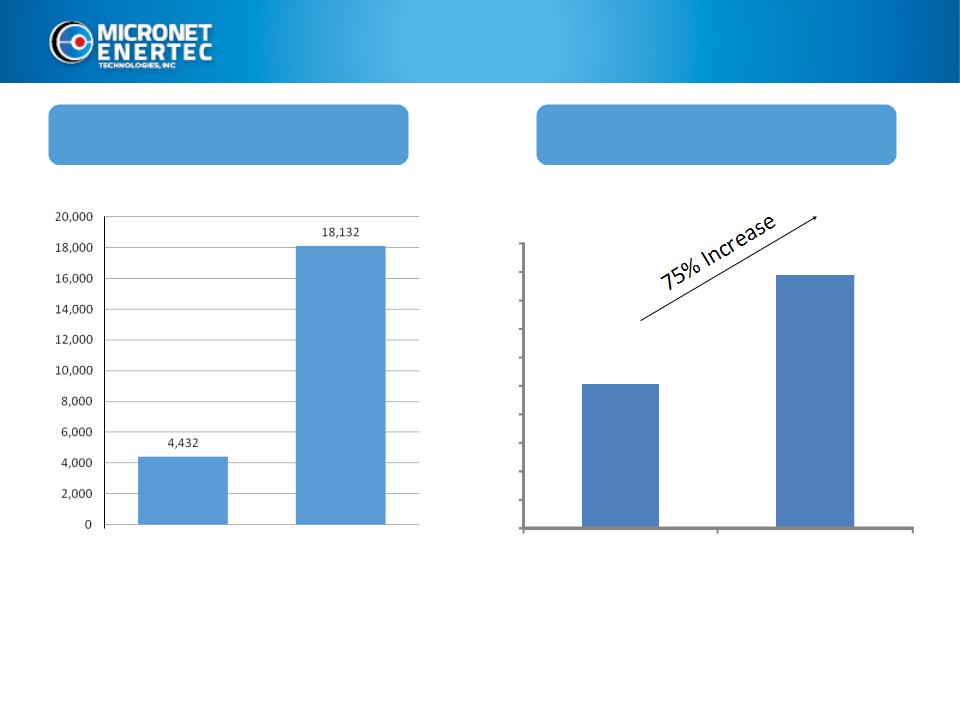

Revenue Performance

Six Month 2013 GAAP

Annual GAAP

(includes only 1 quarter of Micronet results)

Year Ended December 31

Jan-June 2012 Jan-June 2013

$10,146

$17,788

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

2011

2012

Revenue (000)

10,146 17,778 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 75 % Increase 4,432 18,132 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 Jan - June 2012 Jan - June 2013

Six Month 2013 Revenue Breakdown

6

Revenue by Segment

Revenue by Geography

MRM

Aerospace

79%

21%

67%

4%

29%

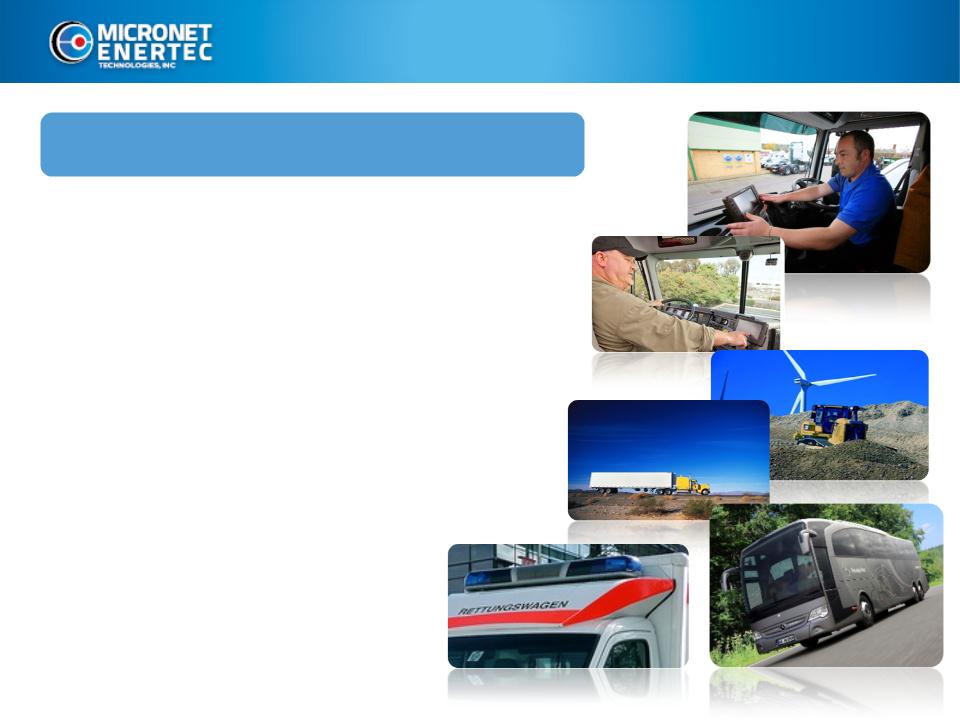

Rugged Tablet Computers for MRM/FM

7

Our mobile fleet management computers help maximize

productivity, reduce costs and improve corporate control by

automating manual workflow processes

productivity, reduce costs and improve corporate control by

automating manual workflow processes

• We provide robust programmable automotive-grade mobile computers

• We supply top-tier fleet management service companies

• We design, develop and manufacture our products in-house

Fit-for-purpose Rugged Tablet Computers

8

Our products are designed to integrate with vehicle power sources

and computer systems, and built to withstand wide temperature

ranges, shock & vibrations, and connect to ancillary devices.

and computer systems, and built to withstand wide temperature

ranges, shock & vibrations, and connect to ancillary devices.

Cellular

GPS

W/LAN

CANBus

Bluetooth

USBs

LAN

Comm Ports

12V/24V

MRM Applications

9

• Time Management and Safety Compliance

• Two-Way Messaging and Task Management

• Dynamic Dispatching and Navigation

• Form-based Reporting

• Proof of Delivery and Invoicing

Key Worker / Workflow Applications

MRM Sectors

10

• Haulage & Distribution

• Construction Supply

• Local Fleets - Technical Services

• Public Transportation - Buses & Taxis

• Municipalities & Utilities

• Public Safety - Police, Fire, Ambulances

Main vertical markets

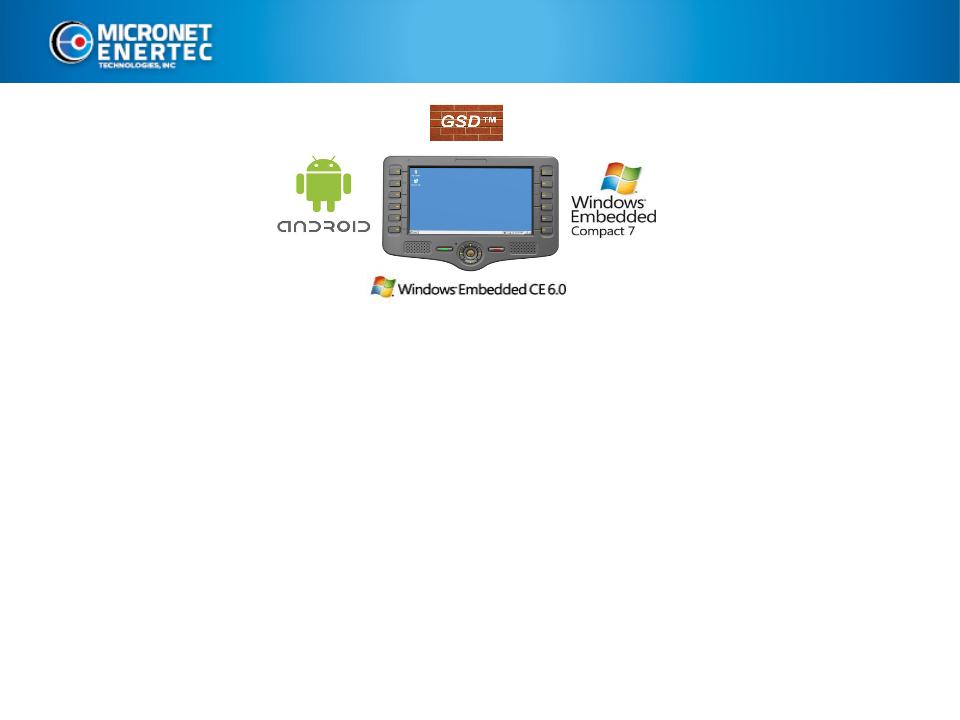

Patent-pending Guardian System Design (GSD) - Cloud-based SaaS

functionality enables remote device monitoring and facilitates user

support and technical trouble shooting

functionality enables remote device monitoring and facilitates user

support and technical trouble shooting

• Remote mobile device management

• Fail-safe and cost effective Firmware and Application Over the Air

(OTA) updates

(OTA) updates

• Recurring revenue business model

Micronet Innovation

11

Platform to serve after-market solutions & truck OEMs

Cloud world

Infotainment

Enterprise

HMI control,

Diagnostics &

virtualization

Micronet Technology Vision

12

Global MRM Market

13

• 13.8 million subscribers as of December 2012

• Expected to grow to 32 million in 2016

• 700,000 companies using MRM today

Sources: C.J. Driscoll & Associates and Licht & Associates, 2012

-

5,000,000

10,000,000

15,000,000

20,000,000

25,000,000

30,000,000

35,000,000

2010

2011

2012E

2013P

2014P

2015P

2016P

MRM Subscribers

23% CAGR

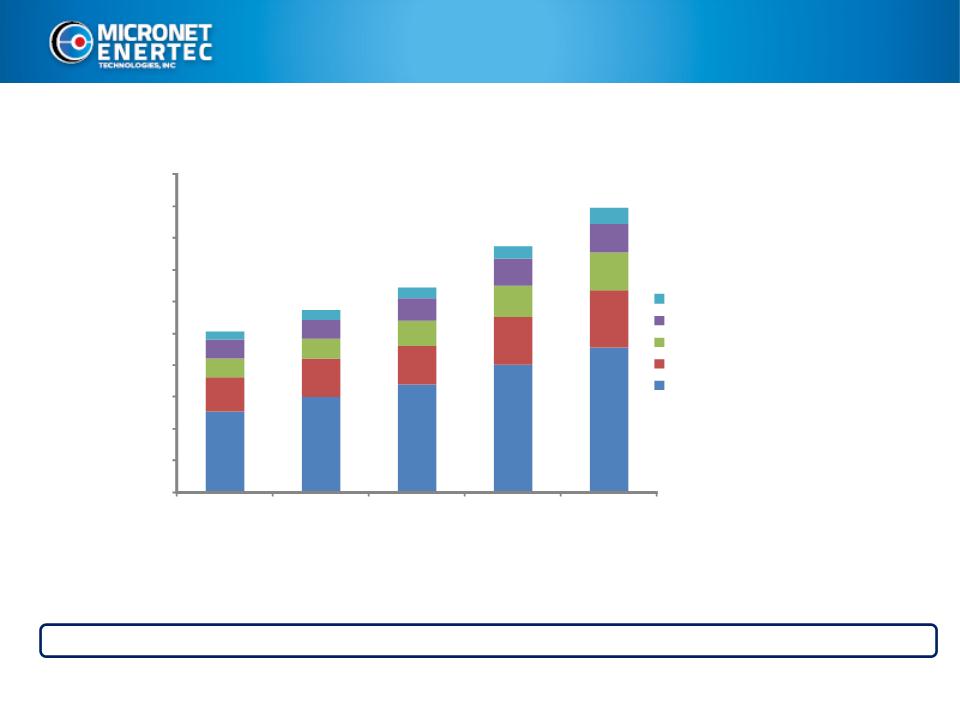

U.S. MRM Market

14

U.S. MRM market today has more than 5 million units in service

• Total U.S. MRM market projected to grow to 9 million units in service by 2015

• 300,000+ companies use MRM systems and services

Source: C.J. Driscoll & Associates

Every million units represent a $400 million revenue opportunity for Micronet

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

8,000,000

9,000,000

10,000,000

2011

2012E

2013P

2014P

2015P

MRM Subscribers

Heavy Equipment Monitoring

Trailer/Container Monitoring Systems

Installed Units

-

Long Haul Trucking

GPS

-

Capable Cell Phones/Smartphones/Tablets

Installed Units

-

Local Fleet Market

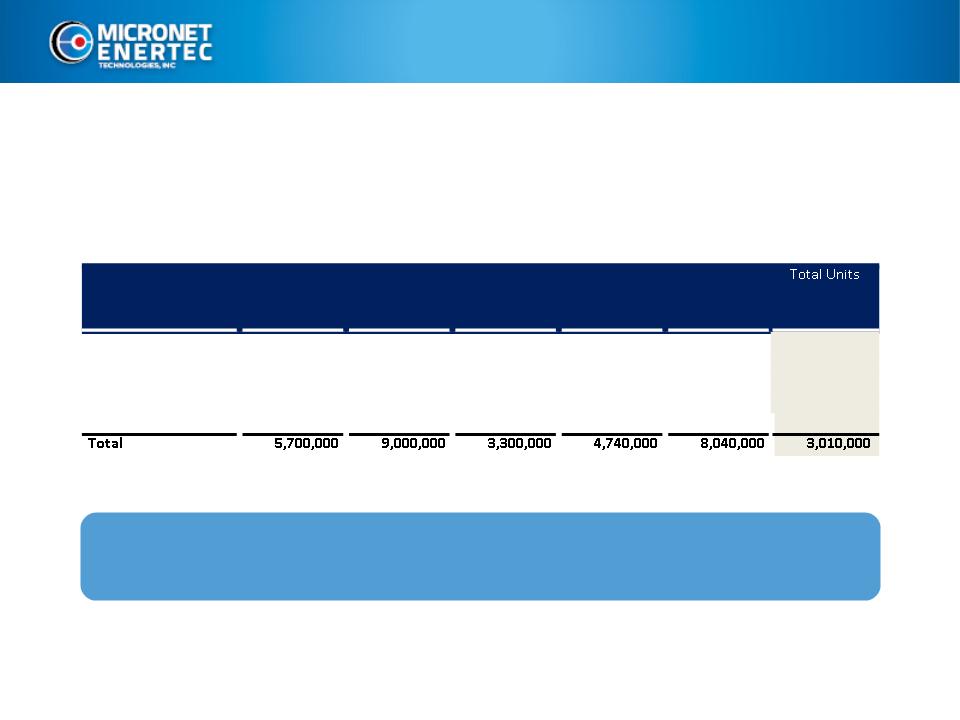

U.S. MRM Growth Analysis

15

• The U.S. is approximately 40% of the global MRM market

• Micronet has already penetrated and sells to major MRM service providers and is

positioned to take a significant share of the U.S. and global market

positioned to take a significant share of the U.S. and global market

3-year potential of 3 million units @ $400/unit

= $1.2 billion in relevant U.S. revenue opportunity (2013-2015)

Sources: Micronet and C.J. Driscoll & Associates

(1) Approximately 20% of installed units are replaced annually

(2) Assumes that 33% of Local Fleet applications are relevant to Micronet

Vertical

2012

Subscribers

2015

Subscribers

New

Subscriber

Growth

Replacement

Units

(1)

Total New

Units

Relevant to

Micronet

(2)

Local Fleet

2,900,000

4,550,000

1,650,000

2,400,000

4,050,000

1,350,000

GPS iPhones

1,230,000

1,800,000

570,000

966,000

1,536,000

-

Long Haul

700,000

1,200,000

500,000

620,000

1,120,000

1,120,000

Trailers/Containers

670,000

950,000

280,000

514,000

794,000

-

Heavy Equipment

200,000

500,000

300,000

240,000

540,000

540,000

Total 5,700,000 9,000,000 3,300,000 4,740,000 8,040,000 3,010,000

Fleet Management Customers

16

Trimble Inc. (NASDAQ: TRMB): A $7 billion market cap corporation,

the second largest provider of FM and MRM solutions with 370,000

installed units

the second largest provider of FM and MRM solutions with 370,000

installed units

Teletrac Inc.: A provider of advanced and interactive fleet

automation software based in California. Teletrac provides solutions

to more than 20,000 fleets with 200,000 vehicles

automation software based in California. Teletrac provides solutions

to more than 20,000 fleets with 200,000 vehicles

Imarda Ltd: A provider of fleet management solutions based in

Australia and New Zealand

Australia and New Zealand

Belgravium Technologies PLC (AIM: BVM): A market leader in

enterprise mobile computing solutions with an installed global

product base of over 300,000 terminals

enterprise mobile computing solutions with an installed global

product base of over 300,000 terminals

Aerospace & Defense Systems

17

MICT military computers and equipment are embedded in the core of

electronic platforms, including: missiles, tanks, combat aircraft, drones,

missile boats, submarines, command and control systems

electronic platforms, including: missiles, tanks, combat aircraft, drones,

missile boats, submarines, command and control systems

Command &

Tracking

Systems

Tracking

Systems

Naval

Communications

Systems

Communications

Systems

Operations

Consoles for

Weapon

Systems

Consoles for

Weapon

Systems

Ground

Command

Systems

Command

Systems

Naval Control

Systems

Systems

Critical Missile Defense Technologies

18

MICT Computers and Equipment are Integrated into Critical Missile

Defense Systems

Defense Systems

Our systems and technology are embedded in the Arrow and Iron Dome missile

programs as well as in naval platforms

programs as well as in naval platforms

19

President Obama - Iron Dome Missiles (command and control computers by MICT)

Critical Missile Defense Technologies

Missile Defense Customers

20

Israel Aerospace Industries (IAI): With annual revenues of over $3

billion, IAI is the largest aerospace and defense company and the

largest industrial exporter in Israel. Globally recognized leader in

development and production of military and commercial aerospace

and defense systems

billion, IAI is the largest aerospace and defense company and the

largest industrial exporter in Israel. Globally recognized leader in

development and production of military and commercial aerospace

and defense systems

Rafael Advanced Defense Systems Ltd: A $1.8 billion revenue

defense corporation involved in all critical projects used by the Israeli

defense forces and many foreign ones

defense corporation involved in all critical projects used by the Israeli

defense forces and many foreign ones

Elbit Systems Ltd. (NASDAQ and TASE:ESLT): A $3 billion revenue

defense contractor with operations in Israel and the U.S.

defense contractor with operations in Israel and the U.S.

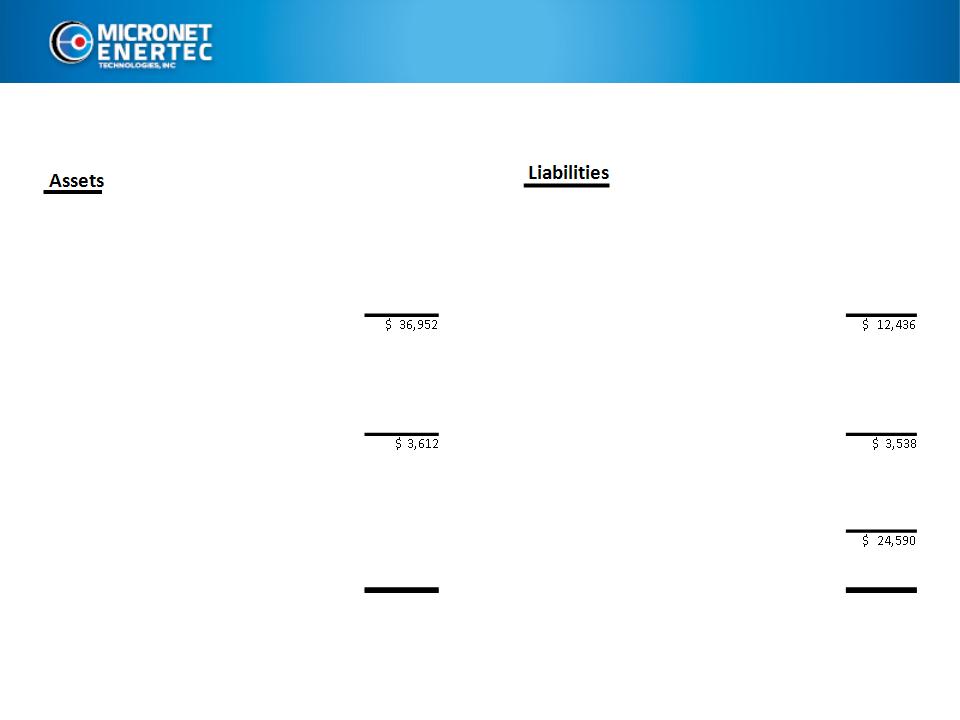

Summary Balance Sheet

21

June 30, 2013 - ($000’s)

Current Assets

Current Liabilities

Cash, cash equivalents & marketable securities

19,189

$

Short-term and current portion of long-term debt

(1)

6,978

$

Accounts Reveivables

10,723

Account Payables

5,436

Inventories

5,325

Other current

22

Other current

1,715

Total current assets

Total current liabilities

Property and equipment, net

2,297

Long-term debt and others

(1)

3,139

Intangible assets and others, net

1,271

Other long-term

399

Long-term deposit

44

Total long-term assets

Total long-term liabilities

Shareholders Equity

Micronet Enertec stockholders

17,577

Non controlling interest

7,013

Total equity

Total Assets

40,564

$

Liabilities and shareholders equity

40,564

$

Long-term assets

Long-term liabilities

$36,952 $12,436 $3,612 $3,538 $24,590

Six Month Highlights 2013 vs. 2012

22

• Revenue: Growth of 309% from $4.4M to $18.1M.

• Operational Income: Increased from $452K to $2.3M.

• Revenue -Aerospace division (Enertec) : A growth of 18%.

• Revenue -MRM Division (Micronet) : A decline of 11%.

• Gross Margin: Increased from 34% to 36%

• EBITDA: Increased from $498K to $3M.

Six Month Summary Financial Data

|

Six months ended

June 30,

|

||||||||

|

2013

|

2012

|

|||||||

|

in thousands

|

in thousands

|

|||||||

|

Revenues

|

$ | 18,132 | $ | 4,432 | ||||

|

Cost of revenues

|

11,618 | 2,915 | ||||||

|

Gross profit

|

6,514 | 1,517 | ||||||

|

Operating expenses:

|

||||||||

|

Research and development

|

1,389 | 109 | ||||||

|

Selling and marketing

|

678 | 175 | ||||||

|

General and administrative

|

1650 | 781 | ||||||

|

Amortization of intangible assets

|

471 | - | ||||||

|

Total operating expenses

|

4,188 | 1,065 | ||||||

|

Income from operations

|

2,326 | 452 | ||||||

|

Financial expenses, net

|

(1,848 | ) | (417 | ) | ||||

|

Other income

|

- | 21 | ||||||

|

Income before provision for income taxes

|

478 | 56 | ||||||

|

Taxes on income

|

130 | 12 | ||||||

|

Share in profit of affiliated company

|

- | (17 | ) | |||||

|

Net income

|

348 | 27 | ||||||

|

Net income attributable to non-controlling interests

|

1,037 | - | ||||||

|

Net Income (loss) attributable to Micronet Enertec

|

(689 | ) | 27 | |||||

23

24

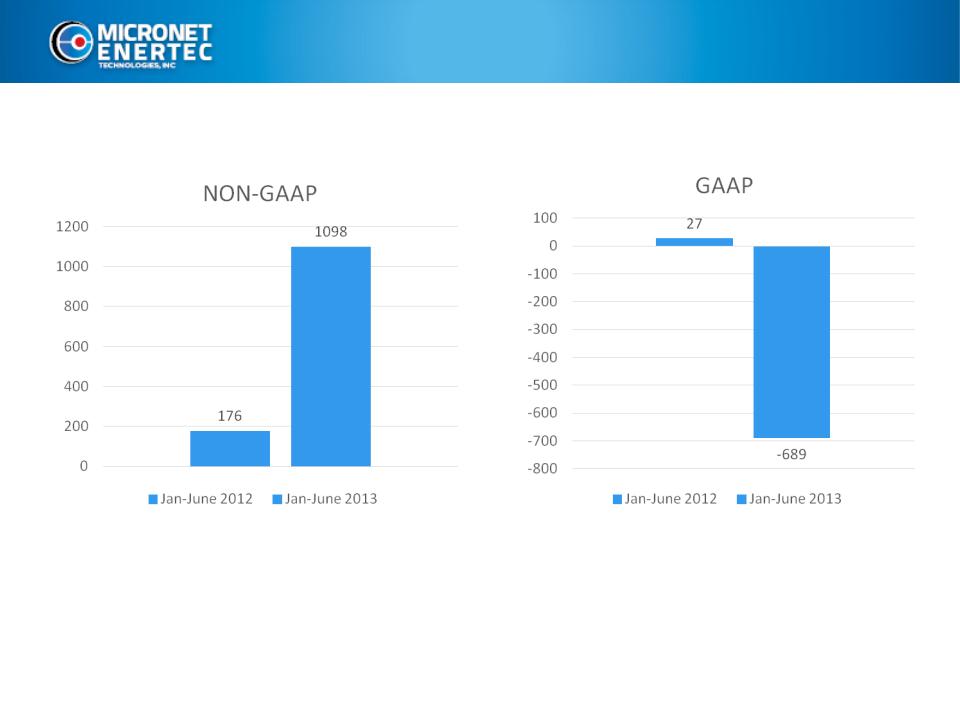

Six Month Net Income Performance

($ in thousands)

176 1098 0 200 400 600 800 1000 1200 NON - GAAP Jan - June 2012 Jan - June 2013 24 27 - 689 - 800 - 700 - 600 - 500 - 400 - 300 - 200 - 100 0 100 GAAP Jan - June 2012 Jan - June 2013

Six Month Consolidated Statements of Income

($ in thousands)

($ in thousands)

|

|

Jan-June 2013

|

|

Jan-June 2012

|

|

|

Sales

|

18,132

|

|

4,432

|

|

|

Gross profit

|

6,514

|

36%

|

1,517

|

34%

|

|

Operating expenses

|

4,188

|

23%

|

1,065

|

24%

|

|

Income from

operations |

2,326

|

13%

|

452

|

10%

|

|

Net GAAP Income

(Loss) |

(689)

|

(4%)

|

27

|

1%

|

|

Net NON GAAP

Income (Loss) |

1,098

|

6%

|

176

|

4%

|

25

Six Month Non-GAAP Financial Measures

($ in thousands)

($ in thousands)

26

|

|

Jan-June

2013 |

Jan-June

2012 |

|

Net income (loss) attributable to Micronet Enertec

|

(689)

|

27

|

|

Amortization of acquired intangible assets

|

471

|

|

|

Change in fair value of warrants

|

193

|

(17)

|

|

Amortization of UTA's note discount and related expense

|

1,188

|

166

|

|

Stock-based compensation

|

6

|

|

|

Income tax-effect of above non-GAAP adjustments

|

(71)

|

|

|

Total non-GAAP net income attributable to Micronet Enertec

|

1,098

|

176

|

|

Non-GAAP net income per diluted share

|

0.29

|

0.05

|

|

Shares used in per share calculations

|

3,727,372

|

3,241,500

|

|

|

|

|

|

GAAP Net income (loss) per share

|

(0.18)

|

0.01

|

Six month Financial Expenses

($ in thousands)

($ in thousands)

|

|

Jan-June

2013 |

Jan-June

2012 |

|

Change in the fair value of the put

and call options |

193

|

-

|

|

Amortization of discount

|

1,188

|

166

|

|

Interest and Exchange differences

|

467

|

251

|

|

Financial expense, net

|

1,848

|

417

|

27

Second Quarter Consolidated Statements of Income

($ in thousands)

($ in thousands)

|

|

April-June 2013

|

|

April-June 2012

|

|

|

Sales

|

7,771

|

|

2,480

|

|

|

Gross profit

|

2,868

|

37%

|

924

|

37%

|

|

Operating expenses

|

2,003

|

26%

|

511

|

21%

|

|

Income from

operations |

865

|

11%

|

413

|

17%

|

|

Net GAAP Income

(Loss) |

(227)

|

(3%)

|

176

|

7%

|

|

Net NON - GAAP

Income (Loss) |

372

|

5%

|

250

|

10%

|

28

Second Quarter Non-GAAP Financial Measures

($ in thousands)

($ in thousands)

|

|

April-June

2013 |

April-June

2012 |

|

Net income (loss) attributable to Micronet Enertec

|

(227)

|

176

|

|

Amortization of acquired intangible assets

|

93

|

|

|

Change in fair value of warrants

|

(105)

|

(9)

|

|

Amortization of UTA's note discount and related

expenses |

619

|

83

|

|

Stock-based compensation

|

6

|

|

|

Income tax-effect of above non-GAAP adjustments

|

(14)

|

|

|

Total non-GAAP net income attributable to Micronet

Enertec |

372

|

250

|

|

Non-GAAP net income per diluted share

|

0.07

|

0.08

|

|

Shares used in per share calculations

|

5,211,888

|

3,241,500

|

|

|

|

|

|

GAAP Net income (loss) per share

|

(0.04)

|

0.05

|

29

Second Quarter Financial Expenses

($ in thousands)

($ in thousands)

|

|

4-6.2013

|

4-6.2012

|

|

Change in the fair value of the put

and call options |

(105)

|

-

|

|

Amortization of discount

|

620

|

83

|

|

Interest and Exchange differences

|

202

|

163

|

|

Financial expense, net

|

717

|

246

|

30

Summary Financial Data, 2011-2012

31

(1) For 2012, the loss of $325 includes $1,171 of inventory amortization and $551 of intangible asset amortization, if excluded, income from operations would have been $1,397

For the year ended

December 31

2012

2011

(in thousands, except share and per share amounts)

Consolidated Statement of Operations Data:

Revenue

17,788

$

10,146

$

Cost of revenue

13,790

6,297

Gross profit

3,998

3,849

Operating Expenses

4,323

1,956

Income (loss) from operations

(1)

(325)

1,893

Other (loss) income

4,893

(534)

Net income

4,568

1,359

Net income attributable to Micronet Enertec

5,417

$

1,359

$

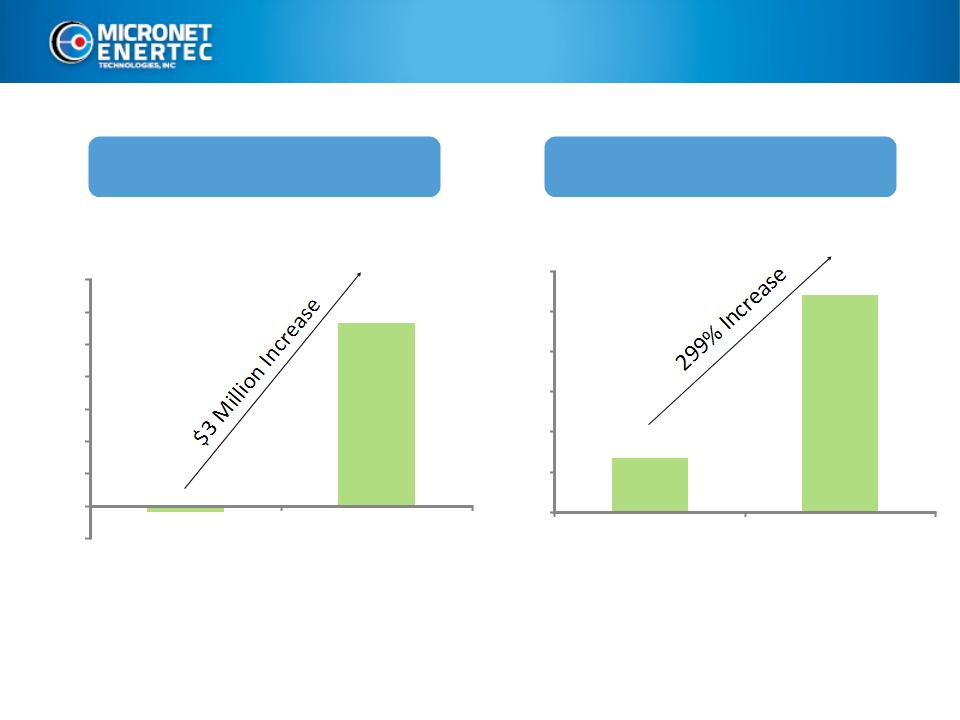

Annual Net Income Performance

32

Consolidated Pro Forma

GAAP

Year Ended December 31

Year Ended December 31

($82)

$2,840

($500)

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2011

2012

$1,359

$5,417

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

2011

2012

Net Income (000)

$3 Million Increase, 299% Increase

Comparable Companies

33

(figures in millions, except per share data)

Price (1)

52 - Week

Equity

Firm

Firm Value / Revenue

Firm Value / EBITDA

Price / Earnings

Company

@ 06/10/13

High

Low

Value

Value (2)

LTM

CY 2013E

CY 2014E

LTM

CY 2013E

CY 2014E

LTM

CY 2013E

CY 2014E

QUALCOMM Incorporated

$62.03

$68.50

$53.09

$107,178

$93,724

4.3 x

3.7 x

3.4 x

12.3 x

9.6 x

8.7 x

17.2 x

13.7 x

12.7 x

Trimble Navigation Limited

26.79

32.03

20.01

6,853

7,646

3.7

3.3

3.0

19.3

21.0

18.1

36.3 x

18.0 x

15.3 x

Elbit Systems Ltd.

44.69

44.78

31.72

1,882

2,337

0.8

0.8

0.8

6.7

6.6

6.4

10.4 x

10.3 x

9.9 x

Zebra Technologies Corp.

45.95

47.24

31.79

2,340

1,926

1.9

1.9

1.8

10.4

9.8

8.8

20.1 x

17.4 x

15.5 x

Fleetmatics Group PLC

31.44

31.61

19.20

1,089

1,011

7.3

6.1

4.9

35.9

21.5

16.2

148.3 x

44.0 x

33.0 x

Astronics Corporation

39.52

39.63

19.25

571

582

2.1

1.8

1.5

14.0

10.7

8.1

23.5 x

20.0 x

16.8 x

Median

$2,111

$2,131

2.9 x

2.6 x

2.4 x

13.1 x

10.2 x

8.8 x

21.8 x

17.7 x

15.4 x

Mean

19,986

17,871

3.4

2.9

2.6

16.4

13.2

11.1

42.6

20.6

17.2

Source: Bloomberg and Wall Street Research

Note: LTM = Latest Twelve Months

NM = Not Meaningful; NA = Not Available

(1) Stock price as of June 10, 2013

(2) Firm Value (FV) equals Equity Value plus debt less cash

Experienced Management Team

34

David Lucatz - Chairman of the Board and CEO

• 25 years’ experience with a successful track record in operations, finance, business development

and management, including:

and management, including:

• Co-owner of ITL Optronics Ltd., an advanced electronics supplier to the defense and security

industries, listed on the Tel Aviv Stock Exchange

industries, listed on the Tel Aviv Stock Exchange

• CEO of Taliplast, a leading manufacturer of Plastic products

• EVP of Securitas, a public finance investments group

Tali Dinar - Chief Financial Officer

• 15 years’ experience managing financial operations in the homeland and defense industries

• Former Manager at Kost Forer Gabbay & Kassierer, a member of Ernst & Young Global

• A former Chief Controller of GCST, a major Global Homeland Security Group, and ITL Optronics

Experienced Management Team (cont.)

35

Rafael Katz, CEO Micronet Ltd

• Experienced high-tech executive, Sales & Marketing background in Telecom industry

• Joined Micronet in 2002 - CEO since 2005 - led company’s IPO in late 2006

• 1997-2002 - CTMotion, Co-founder - CEO, Cellular Location Based Services

• 1988-1997 - Aerotel, VP Sales & Marketing, Computer Telephony Integration (Voice Response)

Zvi Avni, CEO Enertec Systems Ltd

• Mr. Avni is responsible for the unique position of Enertec as a certified supplier and partner for

development of special computers for the defense industry in Israel

development of special computers for the defense industry in Israel

• Mr. Avni graduated the Technion in 1982 and earned a degree as a practical electronic engineer

Investment Highlights

36

Experienced

Management Team

Management Team

§Deep industry expertise

§Proven track record

Diversified Platform

§Proven solution provider

§High-end product line

§Cutting-edge R&D

Improving Financials

§Strong balance sheet

§Growing revenues &

expanding profitability

expanding profitability

Growing Billion $

Global Markets

Global Markets

§Civilian & military

applications

applications

§Major global industry-

leading customers

leading customers

§Organic and M&A focus