Exhibit 99.2

A Diverse Fintech & Agri - Fintech Group Making a Difference Delivering Financial Inclusion and Food Security NASDAQ: TIO Fiscal Year 2022 Financial Results Conference Call March 31, 2023

2 Fiscal Year 2022 Financial Results Conference Call Forward Looking Statements Cautionary Note Regarding Forward - Looking Statements Certain statements made herein contain, and certain oral statements made by representatives of Tingo Group and its affiliates, from time to time may contain, “forward - looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 . Tingo Group and its subsidiaries actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward - looking statements as guarantees or predictions of future events . Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “might” and “continues,” and similar expressions are intended to identify such forward - looking statements . These forward - looking statements include, without limitation, Tingo Group’s expectations with respect to future performance . The statements contained in this report that are not purely historical are forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These statements are based on the beliefs and assumptions of our management based on information currently available to management . Such forward - looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward - looking statements . Most of these factors are outside of the control of Tingo Group and are difficult to predict . Factors that may cause such differences include but are not limited to : ( 1 ) the inability to obtain or maintain the listing of Tingo Group’s common stock on Nasdaq ; ( 2 ) the risk that the integration of the business of Tingo Mobile and its affiliated companies with the historical business of Tingo Group disrupts current plans and operations of Tingo Group ; ( 3 ) the ability to recognize the anticipated benefits of the acquisition of Tingo Mobile and its affiliated companies, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth economically and hire and retain key employees ; ( 4 ) changes in applicable laws or regulations ; ( 5 ) the possibility that Tingo Group may be adversely affected by other economic, business, and/or competitive factors ; and ( 6 ) the impact of the global COVID - 19 pandemic on any of the foregoing risks and other risks and uncertainties identified in the Tingo Group annual report on Form 10 - K for the year ended December 31 , 2022 , filed with the SEC on March 31 , 2023 , including those under “Risk Factors” therein, and in other filings with the SEC made by Tingo Group . The foregoing list of factors is not exclusive . Readers are referred to the most recent reports filed with the SEC by Tingo Group . Furthermore, such forward - looking statements speak only as of the date of this report . Except as required by law, we undertake no obligation to update any forward - looking statements to reflect events or circumstances after the date of such statements . This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any of our securities, nor shall there be any offer or sale of our securities in any jurisdiction in which such solicitation or sale would be unlawful prior to registration or qualification of our securities under the laws of any such jurisdiction .

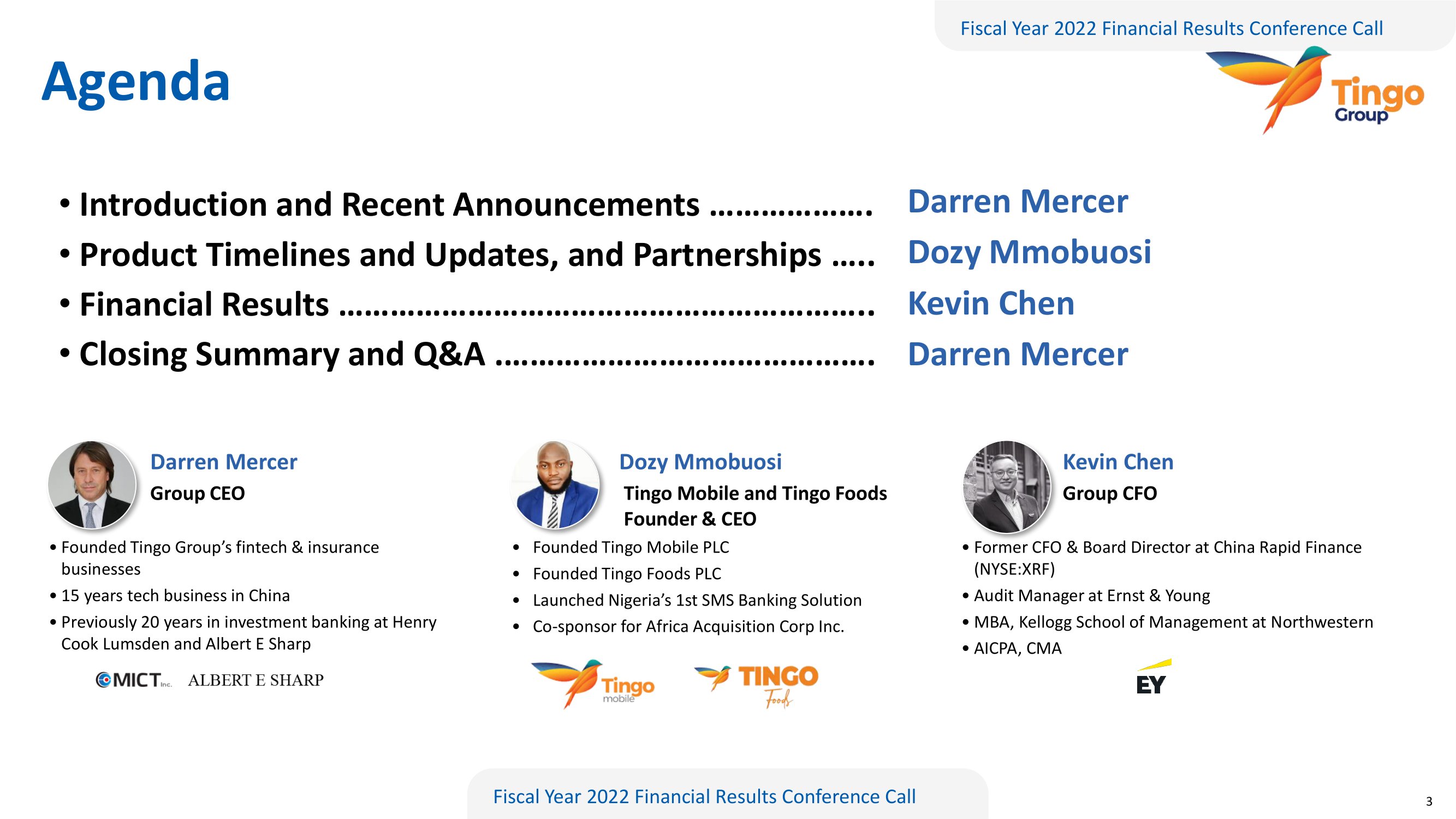

3 Fiscal Year 2022 Financial Results Conference Call Agenda • Introduction and Recent Announcements ………………. • Product Timelines and Updates, and Partnerships ….. • Financial Results …………………………………………………….. • Closing Summary and Q&A .……………………………………. Darren Mercer Dozy Mmobuosi Kevin Chen Group CEO Tingo Mobile and Tingo Foods Founder & CEO Group CFO • Founded Tingo Group’s fintech & insurance businesses • 15 years tech business in China • Previously 20 years in investment banking at Henry Cook Lumsden and Albert E Sharp • Founded Tingo Mobile PLC • Founded Tingo Foods PLC • Launched Nigeria’s 1st SMS Banking Solution • Co - sponsor for Africa Acquisition Corp Inc. • Former CFO & Board Director at China Rapid Finance (NYSE:XRF) • Audit Manager at Ernst & Young • MBA, Kellogg School of Management at Northwestern • AICPA, CMA Darren Mercer Dozy Mmobuosi Kevin Chen Darren Mercer Fiscal Year 2022 Financial Results Conference Call

4 Fiscal Year 2022 Financial Results Conference Call Corporate Overview MICT acquired 100% of Tingo Mobile Limited 2 and Tingo Foods PLC 3 , before subsequently changing name to Tingo Group, Inc. Timeline (1) Pro Forma Financial Information is estimated based on unaudited management accounts (2) See Dec 1, 2022 press release and transaction structure in the attached Appendix (3) See Feb 9, 2023 press release in the attached Appendix 2020 2021 Q4 2022 & Q1 2023 Fintech company providing a range of B2B and B2C proprietary platforms and technology in Southeast Asia Following completion of acquisition of Tingo Mobile on November 30, 2022, Tingo Group is a diverse Fintech and Agri - Fintech group of companies with operations in Africa, Southeast Asia and the Middle East: • Tingo Mobile is a leading fintech and agri - fintech business operating in Africa • Tingo Foods processes crops into finished products from its large farming member base • Tingo DMCC operates a commodities trading platform and commodity export business • TingoPay Super - App , in partnership with Visa, provides payment services, e - wallet and a range of value - added services to customers, and merchant services to businesses • MICT insurance and financial services fintech verticals currently focus on Southeast Asia • Group has significant opportunities to expand internationally Key Highlights 1 $1.15B $674.6M 2022 Pro Forma Revenue 2022 Pro Forma Gross Profit $555.5M $12.7B 2022 Pro Forma Income Before Tax Annualized Dec 2022 Transaction Value on Nwassa Agri Fintech Platform $500.3M 11.4M Cash Balance at Dec 31, 2022 Nwassa Agri Fintech Platform Customers at Dec 31, 2022 4 Initiated acquisition strategy to accelerate growth, utilize strong balance sheet, and leverage platforms, technology and infrastructure Fiscal Year 2022 Financial Results Conference Call

5 Fiscal Year 2022 Financial Results Conference Call Our Mission Make a difference improving global food supply and tackling the world’s food security crisis; by delivering farmer empowerment, improved crop yields, reduced spoilage and better access to markets. Agri - Fintech Mission Group Mission Foster digital and financial inclusion through technology platforms to drive social and economic upliftment 5 Agri - Fintech Mission For Africa Support Africa and its farmers to achieve sustainable food self - sufficiency, bringing an end to Africa’s food insecurity and poverty Fiscal Year 2022 Financial Results Conference Call

6 Fiscal Year 2022 Financial Results Conference Call Acquisition and Recent Developments • Entered into Definitive Merger Agreement with Tingo, Inc. on May 10, 2022 • Completed extensive due diligence on Tingo, Inc. on June 15, 2022, undertaken by world class advisors: Ernst & Young, Dentons, Houlihan Lokey and Ellenoff Grossman & Schole • Merger, which was updated to enable the expedited acquisition of 100% of Tingo, Inc.’s operations and assets (Tingo Mobile) and improve the terms for MICT, was completed on November 30, 2022 • Geographical expansion of Tingo Mobile in Q4 2022 - Ghana, Malawi/East Africa, Dubai • Launched Tingo DMCC commodities trading platform & export business in Q4 2022 • Launched beta version of TingoPay Super App and Visa Partnership in Q4 2022 • Pivot strategy for MICT insurance and fintech verticals commenced Q1 2023 • Tingo Foods acquired in Q1 2023, with aim of building the largest food processing facility in Africa

7 Fiscal Year 2022 Financial Results Conference Call NWASSA Agri Fintech: Clear Growth Strategy Proven Model - Tingo Mobile and NWASSA Marketplace 11.4M ~30.0M Tingo Mobile active customers at Dec 31, 2022 Expected number of Tingo Mobile customers by Dec 2023 • Q4 2022 - Signed All Farmers Association of Nigeria trade partnership, with commitment to increase customer numbers from 9.3M to ~30.0M • Q4 2022 – Expanded into Ghana with Kingdom of Ashanti trade partnership, with commitment to enroll >2.0M new customers • Q4 2022 – Expanded into Malawi - progressing several trade partnerships and establishing base to roll - out across East Africa • Further expansion planned for Africa, Asia and other relevant markets in the world • Tingo Foods and Tingo DMCC expansion to increase offtake and demand for produce from Tingo Mobile farmers

8 Fiscal Year 2022 Financial Results Conference Call Tingo DMCC - Agri Commodity Platform In Partnership with the Dubai Multi Commodities Centre (DMCC) A global commodity platform and export business – completing the seed to sale eco - system • Facilitates the global export of agricultural commodities, including: Crops from Tingo Mobile’s farmers - such as wheat, millet, cassava, ginger, cashew nuts, cocoa and cotton Finished food and beverage products from Tingo Foods – such as rice, noodles, pasta, cooking oils, coffee, tea and chocolate • DMCC is a leading center of international trade and the World’s No.1 Free Trade Zone • Through access to Nigeria’s 60M farmers, including AFAN’s 20M+ farmers, and the farmers of Ghana, Malawi, and other territories, Tingo has access to several billion dollars per annum of agricultural produce for export • Tingo DMCC dollarizes and globalizes Tingo Group, while giving Tingo Mobile’s farmers and Tingo Foods direct access to international markets • Creates a win - win - win situation – improving world food supply; delivering fair prices and empowerment to farmers; and generating substantial high - margin revenues to Tingo DMCC and the wider Tingo Group

9 Fiscal Year 2022 Financial Results Conference Call Tingo Foods – Food Processing Business Aims to be the largest food and beverage processing facility in Africa • Tingo Foods generated more than $400 million of high - margin revenue in first 4 months (Sep 2022 - Dec 2022) – business brought into Tingo Group from Feb 9, 2023 • Set to multiply capacity and revenue with new state - of - the - art $1.6 billion food processing facility in Delta State of Nigeria – scheduled to open early 2H 2024 • Africa’s farmers and agricultural sector to benefit from significant expansion of the Continent’s own processing capabilities – increasing crop demand, giving farmers higher prices and delivering financial upliftment • Expected to deliver: (i) material reduction in farmers’ post - harvest losses; (ii) significant improvement in world’s food security; and (iii) considerable environmental benefits – reducing freight miles, improving production efficiency, reducing food wastage, powered exclusively by renewable energy and reducing carbon footprint Partnership with Evtec Energy PLC to build $150M 110MW Solar Plant, set to achieve net zero carbon emissions and reduced energy costs. A key part of the Tingo Group eco - system from Seed to Sale Creating significant demand and offtake for Tingo Mobile’s Farmers + Creating significant supply for Tingo’s commodity trading and export business

10 Fiscal Year 2022 Financial Results Conference Call TingoPay SuperApp and Visa Partnership • Tingo Mobile and TingoPay in partnership with VISA are designed to accelerate financial inclusion and social upliftment • M aking digital payments and TingoPay’s services easily accessible across Africa through Pan - Africa partnership with Visa, followed by Asia and other Emerging Markets Visa payment services and digital Visa card embedded within the TingoPay SuperApp. Pan - Africa Visa partnership includes marketing and customer acquisition support TingoPay SuperApp offers full range of e - wallet, payment services, marketplace, e - commerce, insurances and finance to customers • TingoPay business portal and Tingo Visa merchant services enable farmers and businesses in all sectors to easily and securely receive payment • Aims to deliver e - wallet and digital payment services to Tingo Mobile’s existing customer base plus Pan - Africa rollout, then Asia and beyond Diversifies and expands Tingo Group into new markets – B2C and B2B

11 Fiscal Year 2022 Financial Results Conference Call Financial & Digital Inclusion Increase Food Supply and Reduce Wastage Social Upliftment Ecosystem Mobile Handsets with Embedded Software & Platforms Marketplace for inputs and produce Valued - Added Services and Payment Services Processing of produce into finished food products Wholesale and Export of Foods and Commodity Trading

12 Fiscal Year 2022 Financial Results Conference Call Environmental, Social & Governance • Fostering digital and financial inclusion through technology platforms – driving the social and economic upliftment of customers • Meaningfully improving global food supply and tackling the world’s food security crisis by e mpowering the farmer - increasing crop yields; reducing post harvest losses; improving access to markets, and; delivering fairer prices • Delivering significant environmental benefits – reducing crop wastage; improving farming and food production efficiency; promoting sustainable farming techniques; reducing freight miles • Adopting a mature ESG framework underpinned and guided by the United Nations’ Sustainable Development Goals 12 Fiscal Year 2022 Financial Results Conference Call

13 Fiscal Year 2022 Financial Results Conference Call Financial Results Highlights • Acquisition of 100 % of Tingo Mobile completed on November 30 , 2022 , resulting in consolidation of financial results into Tingo Group from December 1 , 2022 . • Net revenues of Tingo Group for 2022 were $ 146 . 0 million (excluding Tingo Mobile for 11 months to ended November 30 , 2022 ), compared to $ 55 . 7 million in the prior year, an increase of 162 % , which was mainly attributed to the consolidation of 1 - month revenue of Tingo Mobile . • Operating loss of Tingo Group for 2022 was $ 11 . 8 million, versus a loss of $ 37 . 9 million for the prior year, after accounting for non - recurring transaction expenses of $ 9 . 6 million and share based payments of $ 6 . 6 million . • Pro Forma Consolidated Revenues of the Group for 2022 were $ 1 . 15 billion, compared to $ 0 . 92 billion for the prior year, which after stripping out non - recurring mobile handset sales in 2021 of $ 0 . 3 billion, represented an increase of 85 . 5 % . • Tingo Mobile’s Handset Leasing Revenues for 2022 were $ 476 . 3 million, up 50 . 3 % on prior year revenues of $ 316 . 9 million . • Nwassa Agri Fintech platform revenues for 2022 were $ 532 . 2 million, up 168 . 0 % on prior year revenues of $ 198 . 6 million . • Pro Forma EBITDA 1 for 2022 was $ 954 . 5 million and Net Income Before Tax for was $ 555 . 5 million, compared to Pro Forma EBITDA 1 of $ 275 . 6 million and a Net Loss Before Tax of $ 47 . 7 million for the prior year . • Tingo Group cash balances at December 31 , 2022 , amounted to $ 500 . 3 million, compared to $ 96 . 6 million at December 31 , 2021 . 1 EBITA is considered a non - GAAP measure of financial performance

14 Fiscal Year 2022 Financial Results Conference Call Financial Highlights – Pro Forma Information Yr. over Yr. Pro Forma Combined $ in Millions Growth FY 2022 FY 2021 Mobile handset sales Non - Recurring $24.1 $301.0 Mobile handset leasing 50.3% 476.3 316.9 Mobile call and data 12.2% 61.5 49.3 Nwassa - Airtime 45.5% 14.7 10.1 - Brokerage on loans 1,043.4% 26.3 2.3 - Insurance 78.5% 25.7 14.4 - Trading of agricultural produce 239.4% 273.9 80.7 - Utility bill payment 110.3% 191.6 91.1 168.0% 532.2 198.6 MICT Insurance and Financial Services 3.2% 57.5 55.7 Total Revenue $1,151.6 $921.5 Revenue Analysis

15 Fiscal Year 2022 Financial Results Conference Call Financial Highlights – Pro Forma Information Pro Forma Combined $ in Millions FY 2022 FY 2021 Revenue $1,151.6 $921.5 Gross Profit 674.6 343.7 Operating Income / (Loss) 554.6 (47.0) EBITDA 1 954.5 275.6 Adj. EBITDA 1 954.5 536.3 Net Income / (Loss) Before Tax 555.5 (47.7) Net Income / (Loss) 338.3 (128.9) Cash at December 31, 2022 $500.3 $223.3 Income Statement 1 EBITDA is considered a non - GAAP measure of financial performance

16 Fiscal Year 2022 Financial Results Conference Call Balance Sheet Highlights As of $ in Millions Dec 31, 2022 Dec 31, 2021 Cash and cash equivalents $500.3 $96.6 Total current assets 531.2 127.5 Total assets 1,682.4 177.8 Total current liabilities 265.4 25.4 Total long - term liabilities 90.9 4.7 Convertible Preferred Stock 553.0 - Total equity 773.0 147.7

17 Fiscal Year 2022 Financial Results Conference Call Income Statement (excludes Tingo Mobile for 11 months November 30, 2022) Year ended December 31, 2022 2021 Revenues $ 146,035 $ 55,676 Cost of revenues 81,243 46,456 Gross profit 64,792 9,220 Operating expenses: Research and development 1,689 889 Selling and marketing 11,140 6,814 General and administrative 58,165 36,488 Amortization of intangible assets 5,590 2,925 Total operating expenses 76,584 47,116 Loss from operations (11,792 ) (37,896 ) (Loss) gain of controlling equity investment held in Micronet - (1,934 ) Loss from decrease in holding percentage in former VIE - (1,128 ) Other income, net 2,151 1,261 Finance income (expense), net (750 ) 395 Loss before provision for income taxes (10,391 ) (39,302 ) Income tax expense (benefit) 37,474 (1,791 ) Net loss after provision for income taxes (47,865 ) (37,511 ) Gain (loss) from equity investment (746 ) 353 Net loss (48,611 ) (37,158 ) Net loss attributable to non - controlling stockholders (1,542 ) (730 ) Net loss attributable to TINGO GROUP $ (47,069 ) $ (36,428 ) Loss per share attributable to TINGO GROUP: Basic and diluted loss per share $ (0.36) $ (0.32 ) Weighted average common shares outstanding: Basic and diluted 129,345,764 112,562,199

18 Fiscal Year 2022 Financial Results Conference Call Uniquely Positioned • NASDAQ - listed fast - growth and highly profitable company (2022 Pro Forma Income Before Tax - $555.5M) • Strong balance sheet and cash generation (cash balance at Dec 31, 2022 - $500.3M) • Fast growth, high margin and sticky revenue model, with low customer acquisition cost and low attrition • Full Agri and Food Ecosystem from Seed to Sale • Making a difference addressing global food shortage & food security crises; and a benefactor of price inflation • Visa x Tingo partnership and TingoPay SuperApp expands Tingo into new B2C and B2B markets • Proven proprietary fintech platforms, replicable in new geographical markets and new sectors • Vast addressable global market • Significant ESG impact 18 Fiscal Year 2022 Financial Results Conference Call

www.tingogroup.com Company 201 - 225 - 0190 info@tingogroup.com Investor Relations Chris Tyson/Larry Holub 949 - 491 - 8235 TIO@mzgroup.us A Global Fintech & Agri - Fintech Group Making a Difference Delivering Financial Inclusion and Food Security NASDAQ: TIO Q&A